In a previous article (here) we described the SABR model and its pricing formula.

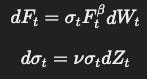

The implied volatility parameter changes from being a constant (in Black-Scholes) to a function of the underlying (F).

The change in the implied volatility function means that the derivatives of the option pricing formula is no longer a simply derivative but instead requries the chain rule.

In this article, we’ll unpack:

The Black-Scholes delta

The SABR delta

1. Black-Scholes Delta

The delta estimates the change in the option price when the price of the underlying changes. It is the derivative of the option price formula with respect to the underlying:

It assumes that implied volatility is constant across all strikes (which is often not consistent to what is observed in the market).

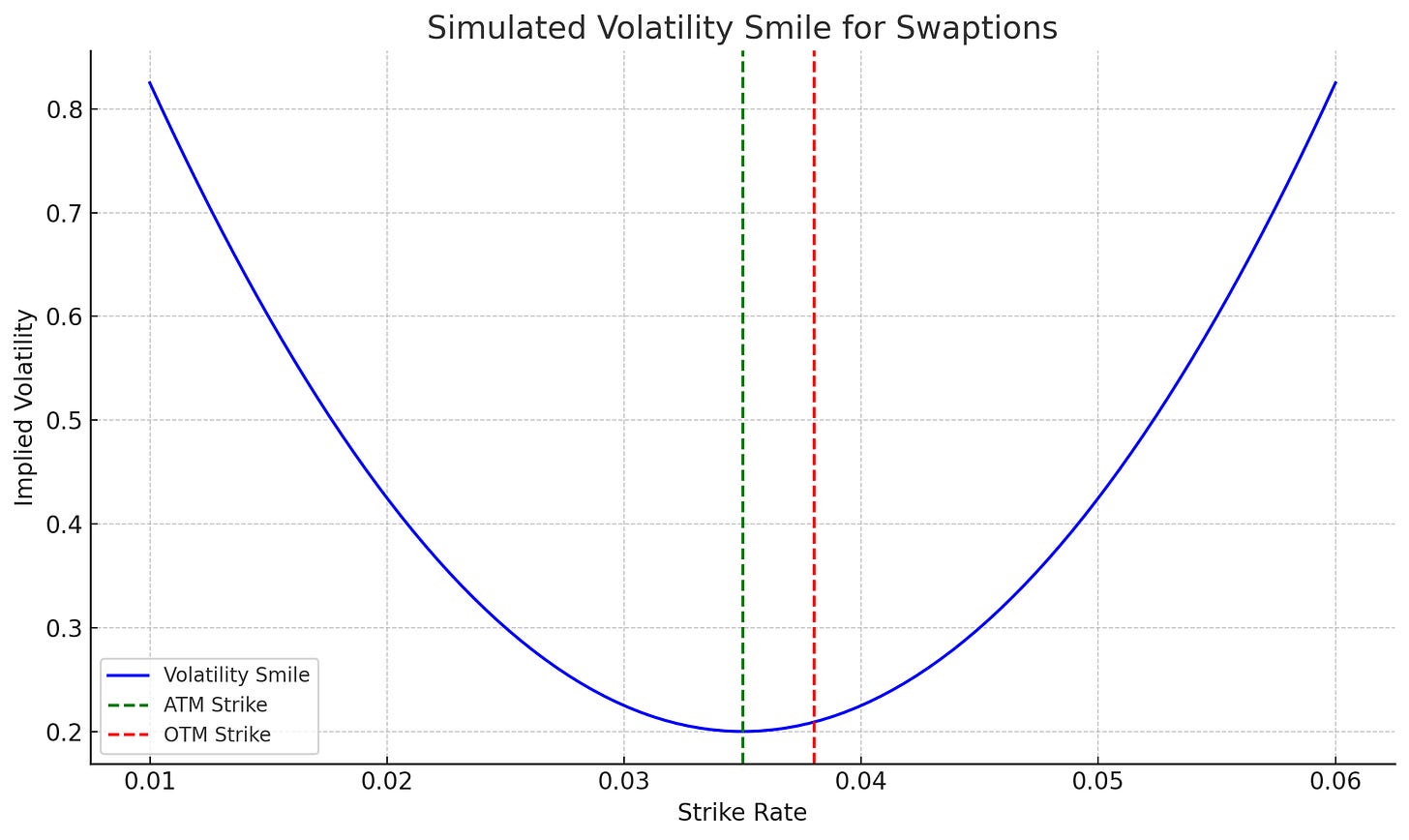

2. SABR Delta: Accounting for the volatility smile

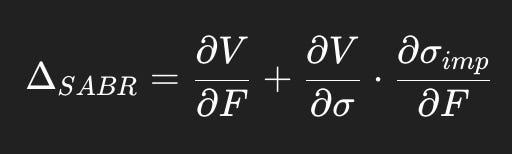

In the SABR model, volatility is a function of the forward rate, which introduces an additional source of sensitivity. The derivative now requires the chain rule.

Where:

The first term is the sensitivity of option price to changes in the forward

The second term captures how the option price changes indirectly via changes in volatility when forward rates move

To put it simplier, if the underlying of the option changes, it becomes more out-the-money. As the option becomes more out-the-money, its implied volatility increases (due to the volatility smile) and hence the option price changes. The SABR delta takes this effect into account whereas the Black-Scholes delta does not.

As a result, the Black-Scholes delta often under hedges when there is a signficant volatility smile.

Interview Guide (OUT NOW)

What’s inside the Quant Prep Interview Guide:

Time-Saving Strategies: Proven tips to land interviews efficiently, skipping the grind of endless applications.

Interview Mastery: A step-by-step breakdown of the process, packed with best practices and winning strategies.

Salary Insights: A detailed list of front-office compensation figures.

Industry Directory: A comprehensive roundup of top financial services firms.

Real-World Prep: 6 authentic interview experiences, covering 18 rounds of questions.

Extensive Question Bank: 138 carefully curated questions spanning Finance, Probability & Statistics, Math & Linear Algebra, Python, Algorithms, and HR.

HR Excellence: Tested techniques to shine in HR interviews.

Now on Sale: Just $21.60 (VAT included) - a steep discount from the regular $39.60.

Ready to land a $200k+ quant role? Grab your copy HERE.

Other Media

Twitter: @quant_prep

Medium: @quant_prep

LinkedIn: Quant Prep

Free Stoikov Market Making Code: Here

Free BTC Options Notebook: Here

Free CV template: Here

Interview Questions Vault: Here