Best Quant Finance masters programs + tips if you don't take these courses

Best ranked Quant Finance masters + tips if you didn't take these courses

The best quant finance masters courses

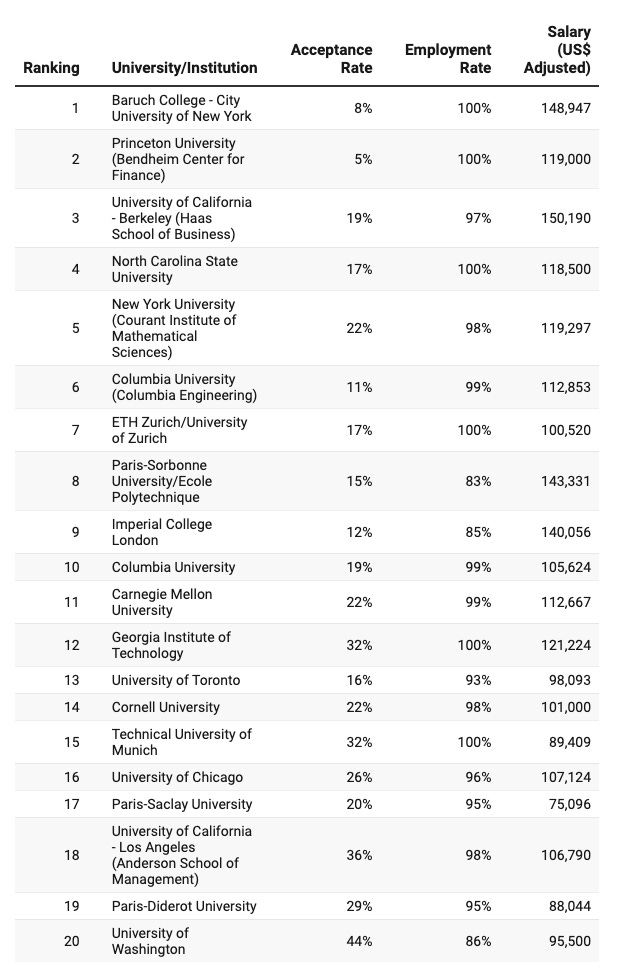

Let’s go through the top 20 best quant finance courses. These may also be called Masters in Financial Engineering. These rankings are put together by Risk.net which is a well-known publication in the industry.

Baruch College is ranked top and has consistently ranked top for many years. Baruch is known for its rigorous curriculum as well as its industry connections. Furthermore, graduates of the Baruch program have a strong track record of securing high-profile positions in hedge funds and investment banks with a high average starting salary of $148k. In addition, its tuition fees are also relatively cheap at $42k compared to $125k for Princeton.

In the UK, the highest ranked is Imperial College London which is known for science and technology. Imperial College is known to have a distinguished faculty with lecturers who have many publications and are well-known in the industry (for example Damiano Brigo). Graduates of the Imperial College Masters in Mathematics and Finance have a average starting salary of $140k.

In France, the highest ranked is Ecole Polytechnique which is one of the renowned Grand Ecoles and is notourious for its touch entrance exams. It has a long history of excellence in science and engineering education. The graduates of its Master’s in Probability and Finance have an average starting salary of $143k.

Tips for if you don’t take a Quant Finance masters course

You may be wondering if it’s still possible to become a quant even if you didn’t take one of these courses. While it may be easier to become a quant if you do take a Quant finance masters course, it’s still possible to become one even if you don’t.

Here are some of my tips if you want to maximise your chances of becoming a quant without taking a Quant finance masters:

Study maths, engineering or physics: You don’t necessarily need to take a quant finance masters, but you do need to study maths, physics or engineering in your bachelors. I would say the preferance is maths, followed by physics and then engineering.

Take the finance, statistics, coding modules offered in your course: You will be expected to be proficient in statistics and coding. You will also be expected have at least basic knowledge of finance: derivatives, options, futures, bonds, etc.

Get the best grade possible: This should be obvious. The best firms want to hire the smartest people.

Try to go to a top school in your country: Not everyone can afford to study abroad and go to the world’s best universities. However, you should at least go to one of the best universities in your country.

Interview Guide

I’m compiling a guide for Quantitative Finance interviews. It will include:

Valuable tips on securing interviews efficiently and avoiding the time-consuming process of applications

A detailed overview of the interview process, including best practices and strategies for success.

A comprehensive interview preparation roadmap

Technical practice questions including: Probability & Statistics, Finance & Derivatives, Python, Algorithms, Linear Algebra, and more.

Insightful questions to ask your interviewer to show your interest.

Proven ways to excel in HR interviews.

My real-life interview experiences + questions that were asked.

If you’d like to ace your next Quant interview, join the waiting list: here

Other Media

Twitter: @quant_prep

LinkedIn: Quant Prep

Medium: @quant_prep

Free Stoikov Market Making code: here

Free BTC Options Scenario Analysis code: here