Benchmark Interest Rates: LIBOR, SONIA, EONIA, ESTR & SOFR

Learn about the benchmark interest rates in the financial markets.

This article will discuss key benchmark interest rates in the financial markets:

LIBOR

SONIA

EONIA

ESTR

SOFR

We’ll look at what they are, how they work, and why some have been phased out. These interest rates are key to the bond, swap and futures market.

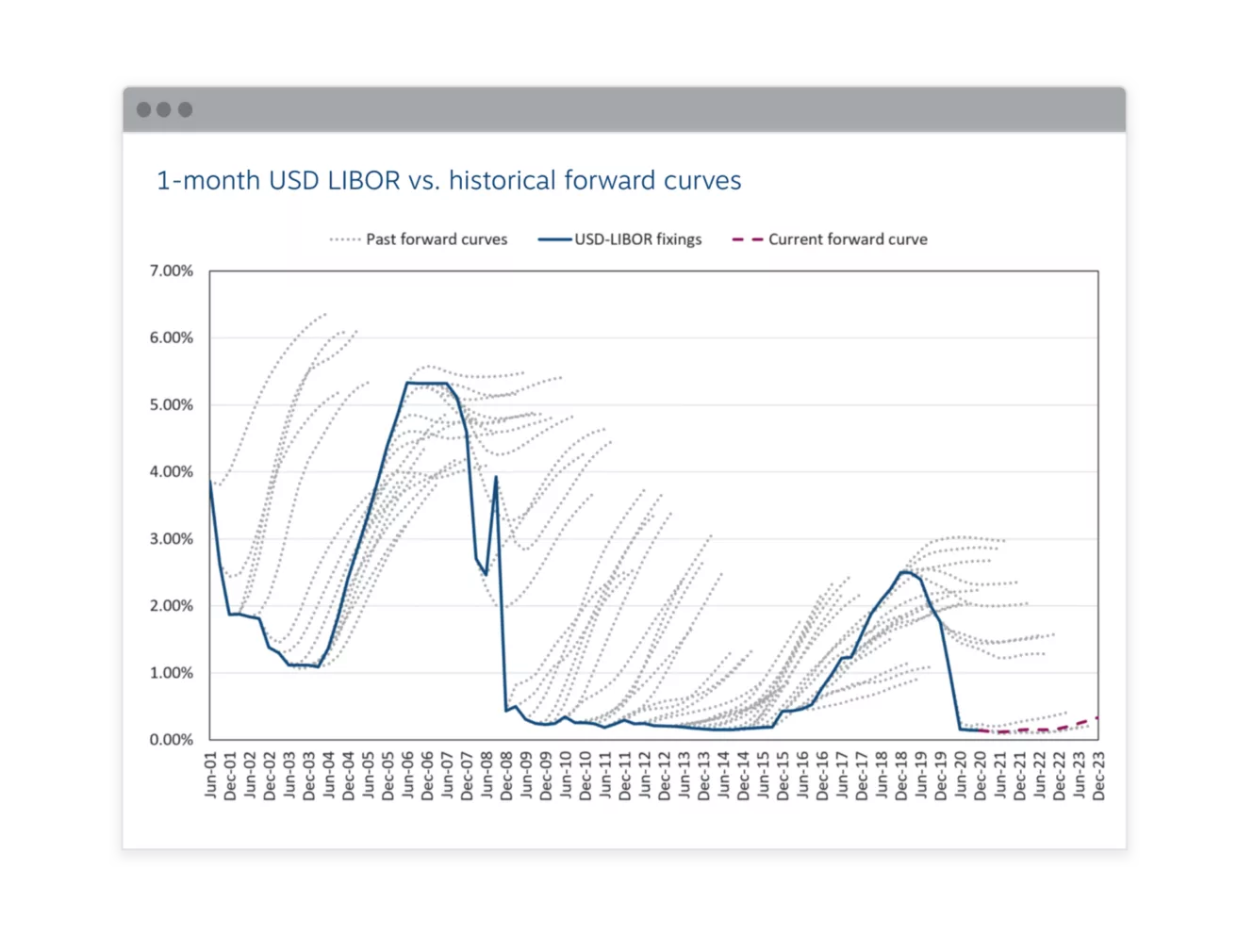

LIBOR (London Interbank Offered Rate)

LIBOR is a benchmark interest rate at which major banks lend to one another. It is calculated and published daily for different maturities (1m, 3m, 1y, etc) across multiple currencies (GBP, USD, EUR, etc).

Historically, LIBOR was used as a reference rate for various financial products, including loans, derivatives, and mortgages.

However, due to the LIBOR scandal in 2012, LIBOR is being phased out and replaced by more reliable overnight interest rates stated below.

SONIA (Sterling Overnight Index Average)

SONIA is the benchmark interest rate for the U.K., reflecting the cost of unsecured overnight borrowing between banks in the GBP market. It is used as a replacement for GBP LIBOR.

SONIA is based on actual transaction data, making it a robust and reliable reference rate. It is calculated as a trimmed mean of the interest rates on unsecured GBP overnight transactions.

EONIA (Euro Overnight Index Average)

EONIA was a benchmark interest rate representing the overnight unsecured lending rate between European banks.

However, due to a shift towards more robust benchmarks, EONIA has been phased out. It was officially replaced by the Euro Short-Term Rate (ESTR) at the start of 2022.

During the transition, EONIA was calculated as ESTR plus a fixed spread of 8.5 basis points.

ESTR (Euro Short-Term Rate)

ESTR is a benchmark interest rate for the eurozone, reflecting the cost at which banks can borrow overnight in the euro money market.

ESTR is based on a broad range of actual transaction data, making it more representative of borrowing conditions in the eurozone.

SOFR (Secured Overnight Financing Rate)

SOFR is a benchmark interest rate for U.S. dollar-denominated loans, based on the cost of borrowing cash overnight while using U.S. Treasury securities as collateral. It reflects the actual transactions in the overnight repurchase (repo) market.

Since it is based on secured transactions, SOFR is considered a more reliable measure of borrowing costs than LIBOR.

Interview Guide

I’m compiling a guide for Quantitative Finance interviews. It will include:

Valuable tips on securing interviews efficiently and avoiding the time-consuming process of applications

A detailed overview of the interview process, including best practices and strategies for success.

A comprehensive interview preparation roadmap

Technical practice questions including: Probability & Statistics, Finance & Derivatives, Python, Algorithms, Linear Algebra, and more.

Insightful questions to ask your interviewer to show your interest.

Proven ways to excel in HR interviews.

My real-life interview experiences + questions that were asked.

If you’d like to ace your next Quant interview, join the waiting list: here

Other Media

Twitter: @quant_prep

Medium: @quant_prep

LinkedIn: Quant Prep

Free Stoikov Market Making Code: Here

Free BTC Options Notebook: Here

Free CV template: Here